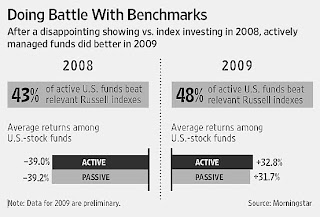

If a picture or in this instance, a graph could speak volumes, this one would. In 2009, actively managed funds, despite lower inflows, outperformed their respective benchmarks handily.

In any given year, a handful of active mutual funds will do better than the benchmark index fund. And investors are usually warned, and I obligated to as well, that what is hot today or last quarter, even over the past year in all likelihood will not be so after you invest. This is why it is always recommended to look much further afield, at least five years, ten is even better see how well a fund has performed.

Should you switch your investment style in your retirement portfolio as a result? Read more here.

Paul Petillo is the managing editor of Target2025.com.

Saturday, January 9, 2010

Monday, January 4, 2010

Resolution Time: Fixing a Few Bad Investment Habits

Most of us look at the turn of a calendar year with the hope that the investment mistakes we made in the previous year will not be made in the new one. This is noble and in many cases futile. These attempts are usually too difficult to handle, which is why, in many cases you haven't done anything before this point.

But with little effort, you can change how you invest. For the vast majority of us, investing requires far too much time. It requires continued education (which I fully recommend), frequent monitoring (which can involve little more than opening your statement just to make sure your investments are going where you intended) and a clear-cut understanding of where you are on the timeline (beginning to invest or at it for awhile).

Altering bad investment habits is not that difficult. Five Tips for 2010...

Paul Petillo is the Managing Editor of Target2025.com

But with little effort, you can change how you invest. For the vast majority of us, investing requires far too much time. It requires continued education (which I fully recommend), frequent monitoring (which can involve little more than opening your statement just to make sure your investments are going where you intended) and a clear-cut understanding of where you are on the timeline (beginning to invest or at it for awhile).

Altering bad investment habits is not that difficult. Five Tips for 2010...

Paul Petillo is the Managing Editor of Target2025.com

Friday, January 1, 2010

A New Year with a New Outlook

2010 will be the year of stabilization. A year where, if you have a job, you will probably still be working at the beginning of 2011 and if you are not, you may find employment; one where if you are prudent (and by that I mean not-so-conservative but cautious), you will find the equity markets still performing better (but not better than expected); one where we have learned lessons that should not be soon forgotten.

Read the full article from Paul Petillo, Managing Editor of Target 2025.com here.

Read the full article from Paul Petillo, Managing Editor of Target 2025.com here.

Labels:

2010,

equities,

investments,

Paul Petillo,

retirement portfolios

Subscribe to:

Posts (Atom)